You are using an outdated browser. Please upgrade your browser to improve your experience.

Article | 13 December 2022 | Investments

2022 was the year of inflation and interest rate hikes. The invasion of Ukraine sent energy prices soaring and pushed inflation to multi-decade highs. And central banks put their foot on the gas with rapid rate hikes. Equity bear markets were commonplace, while bond markets suffered a sharp sell off. We present the pick of the Quick Looks as the year unwound.

‘As January goes, so goes the year’. Or that’s how the old saying goes. It’s certainly been a tough start for the tech sector. In the US, the Nasdaq index fell into correction territory, that’s 10% off November’s peak. Apple briefly became the first company ever to be valued at $3 trillion, before markets started to wobble. But why now? The expected direction of interest rates holds the key. Growth companies have their best earnings in the future. And rising rates weigh on the calculation of the fair value of those future earnings today.

Despite intensified diplomatic efforts, a military invasion of Ukraine was launched by Russia. The first wave of sanctions, initially mainly financial, were imposed on Russia by NATO member states. Markets were forced to contend with two sources of uncertainty- not only macroeconomic, but also geopolitical. It’s little wonder that volatility levels have risen sharply. Meanwhile in the commodity markets, the price of oil breached $100 per barrel, as Russia is the world’s second largest oil producer. And gold has been in greater demand, proving its worth as a safe haven asset.

After embargoes were slapped on oil exports, Russia closed down a crucial pipeline, apparently for essential repairs. It’s the classic supply squeeze. And when supply is constricted, prices rise. President Biden is under pressure to find alternative sources, as gasoline prices soar. He has ordered the US shale oil sector to do ‘whatever it takes’ to pump more oil. Channels have been reopened with Iran and Venezuela, long banned from the world market. The president even called Saudi Arabia and the UAE directly, seeking a production boost, but neither country would take his call.

Shanghai, China’s financial hub, was among major cities locked down in response to Covid-19 outbreaks. The stringent zero-Covid policy has called Chinese GDP growth targets for this year into question, after retail sales dropped by 3.5% in March alone. What’s more, the renewed lockdowns have brought fresh bouts of disruption to manufacturing supply chains in the Far East, likely further damaging global trade. Meanwhile, the IMF (International Monetary Fund) cut its global GDP forecast sharply, warning of the danger to growth from the pandemic debt mountains built up in China and elsewhere.

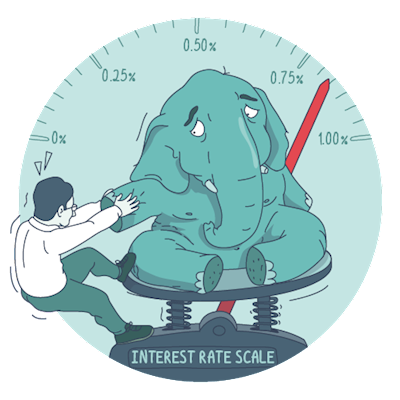

US Federal Reserve (Fed) Chair Jay Powell puzzled the markets by promising a ‘softish’ landing for the US economy. It’s not a word that’s often heard in this context. With inflation at a 40 year high, the Fed acknowledges a ‘difficult balancing act’ to choke it off without triggering a recession. And the global backdrop looks tough, with other economies facing major headwinds. China will struggle to record positive growth this quarter, after Covid lockdowns, and German growth could be dragged down by the costs of switching from Russian gas, following the EU ban.

The US Federal Reserve (Fed) hiked interest rates by 75 basis points and sent financial markets reeling. Not least because a 50 basis points hike had been signalled. It’s a clear message that the Fed aims to act decisively against red hot inflation. Meanwhile the World Bank cut GDP growth forecasts due to the speed of interest rate and energy price rises, once again raising the spectre of stagflation. The central banks of Switzerland and the UK swiftly followed the Fed’s hike, whereas China maintained an easy monetary policy following Covid lockdowns.

Although little known in global markets, Chinese auto maker BYD has taken the World No 1 slot for sales of electric vehicles. The company, whose name stands for ‘Build Your Dreams’, has leapfrogged the ambitions of established car manufacturers such as VW or Ford to beat Tesla into second place. Meanwhile, Tesla founder Elon Musk is locked in legal battle with Twitter, after withdrawing his takeover bid. The social networking giant alleges he treated the transaction agreed in April as an ‘elaborate joke’. Perhaps not so much the $1 billion fee now demanded in recompense.

President Biden’s Inflation Reduction Act passed both Houses of Congress and was written into law. Worth more than $700 billion, the proposals are a scaled back version of the post-Covid Build Back Better programme, originally pitched at $4 trillion. While aiming to cut back inflationary forces, such as prescription drug pricing, the act also targets climate for the first time. Long-term tax credits will be offered to renewables developers. It’s an important win for Joe Biden ahead of the mid-term elections in November. But it has also been hailed as a ‘generational opportunity for clean energy’.

Events aligned to push the dollar to its highest level for 20 years. The Fed announced a 75 basis points interest rate hike, while the Bank of England slowed its hiking pace in response to growth fears. The Bank of Japan intervened in the currency markets for the first time since the 1990s, as the yen marked a fall of almost 25% against the greenback this year. Plans to mobilise more Russian troops in Ukraine pushed the safe haven dollar higher still. Meanwhile, the World Bank warned of growth risks if interest rate hikes continue.

A US court issued a deadline of 28 October for Elon Musk to complete his $44 billion bid for Twitter. And he agreed. The question remained as to why, after months spent refusing to pay up for the allegedly bot-ridden social media platform, the deal was suddenly back on. One clue is Musk’s dream to create an ‘everything app’. Meanwhile rival billionaire Jeff Bezos warned that, as Tesla now relies on Chinese manufacturing for one third of its business, both Musk and Twitter could become exposed to threats of censorship.

US interest rates might now stay ‘higher for longer’, but Jay Powell, president of the Federal Reserve, indicated that the ‘jumbo’ rate hikes of the last four meetings could be a thing of the past. Other Fed governors flagged that recent rate hikes might just prove excessive, after the October inflation print undershot forecasts. Markets rallied in hopes of a pivot to lower rates next spring. But a European Central Bank board member told a different story, suggesting government help with fuel bills could prevent a fall in demand. Meaning inflation stays higher for longer instead.

As the old year closes and a new one begins, familiar questions continue to fixate the markets. How close are we to peak inflation? And how soon can we expect a pivot to lower interest rates? 2023 might bring a boost to global growth, as China turns its back on zero-Covid restrictions. In contrast, recession is forecast for major western economies. Hopes for a resolution to the conflict in Ukraine remain distant. Only time can tell how these events will play out. In the meantime, we wish all our readers a happy and successful 2023!