You are using an outdated browser. Please upgrade your browser to improve your experience.

Article | 02 December 2021 | Investments

QUICK LOOK

The Markets

-0.8%S&P 500 |

-4.4%EURO STOXX 50 |

-2.5%FTSE 100 |

-1.6%CAC 40 |

-3.8%DAX 30 |

-3.9%BEL 20 |

-4.0%FTSE MIB |

-8.3%IBEX 35 |

-3.6%TOPIX |

| Source: Bloomberg 30.11.2021 |

EVs dwarf rivals

After Tesla’s valuation topped $1 trillion for the first time, the share price of Rivian doubled swiftly following its Nasdaq listing. The company, which is backed by Amazon and Ford, plans to make electric SUVs and pick-up trucks. It is now more highly valued than VW, which makes over 9 million cars annually and turns a profit close to €10 billion ($11.2 billion). By contrast, Rivian has not yet made any significant sales, despite operating since 2009. Meanwhile Elon Musk sold 10% of his Tesla stake after first polling his Twitter followers.

Action versus inaction

Following months of careful market preparation, the US Federal Reserve (Fed) confirmed the tapering of its emergency bond-buying programme. Monthly purchases are to be wound down, finishing altogether by the summer of 2022. But already some Fed governors have suggested the pace should be accelerated, to allow ‘liftoff’, or a return to interest rate rises, sooner. Meanwhile, the Bank of England stalled after hints of a rate rise in November, preferring to wait for post pandemic labour markets to settle. And the European Central Bank remained resolute that rates will not rise throughout 2022.

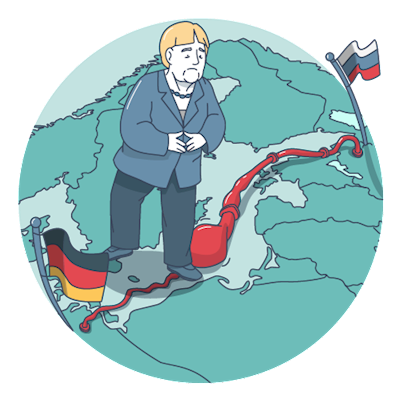

Surge of energy

Gas prices leapt again in Europe, touching €100 per megawatt hour, as Germany halted approval of the Nord Stream 2 pipeline. That compares with €64 a week earlier. The oil price, meanwhile, steadied around $80 per barrel, anticipating a release from the US Strategic Petroleum Reserve. In the end, the 50 million barrels released, about half the daily amount used globally, were not enough to cap off the rally, and the oil price bounced. Allowing President Biden to call this rise a threat to global recovery, as inflation proves anything but ‘transitory’.