You are using an outdated browser. Please upgrade your browser to improve your experience.

Article | 25 May 2021 | ESG

By Mary-Therese Barton, Head of Emerging Market Debt at Pictet Asset Management

Governments everywhere are racing to lock in historically low borrowing costs by issuing ever longer dated debt – in recent years Mexico and Argentina even managed to sell century bonds. That presents several new challenges for fixed income investors. Particularly those who own emerging market bonds.

Investors with allocations to emerging market debt now need to understand the true impact on developing economies of long run factors like climate change and human capital development.

Mary-Therese Barton, Head of Emerging Market Debt at Pictet Asset Management

Not only do bondholders have to weigh the usual near-term factors like political, economic and commodity cycles but, in lending money to sovereigns over such extended periods, they now also have to consider the impact of longer term trends such as climate change and social development. Both can affect creditworthiness in profound ways.

This has called for new approaches to investment thinking. Economic and financial forecasts are having to be recast with climate dynamics in mind. Meanwhile, modelled pathways of climatic change are themselves subject to expectations about future technological change as well as the evolution of political thinking in these countries. The number of moving parts only grows as investors realise they also have a role to play in shaping how governments approach making their economies sustainable and low-carbon.

It’s a complex problem. But not an insurmountable one.

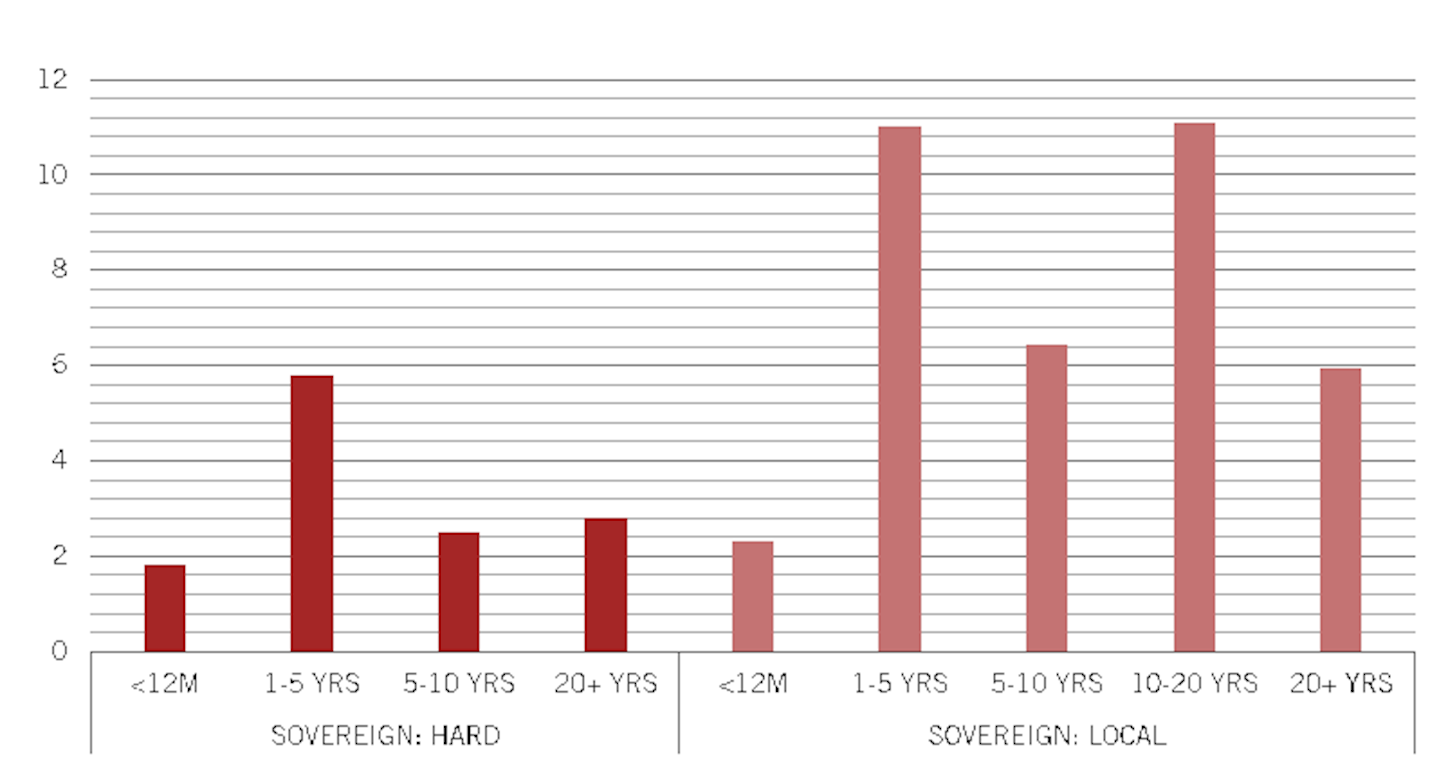

In 2015, some 17 per cent of emerging market hard currency debt had a maturity of 20 years or more. By the start of 2021, that proportion had grown to 27 per cent. Even local currency denominated emerging market debt, which tends to be shorter-dated, has moved along the maturity curve. Over the same time period, the proportion of local currency debt with a maturity of five years or longer had risen 11 percentage points to 58 per cent.

That shift reflects growing demand for yield from investors starved of income. But at the same time, bondholders have recognised the importance of taking a long-term view on environmental issues. This is apparent in both the appetite for green bonds – capital earmarked for environmental- or climate-related projects – and, more generally, bonds that fall under the environmental, social and governance (ESG) umbrella.

Governments are happy to meet that demand. Increasingly, they recognise the need to make efforts to mitigate climate change, and given that emerging market economies make up half the world’s output, they have a significant role to play in meeting global greenhouse gas emissions goals.

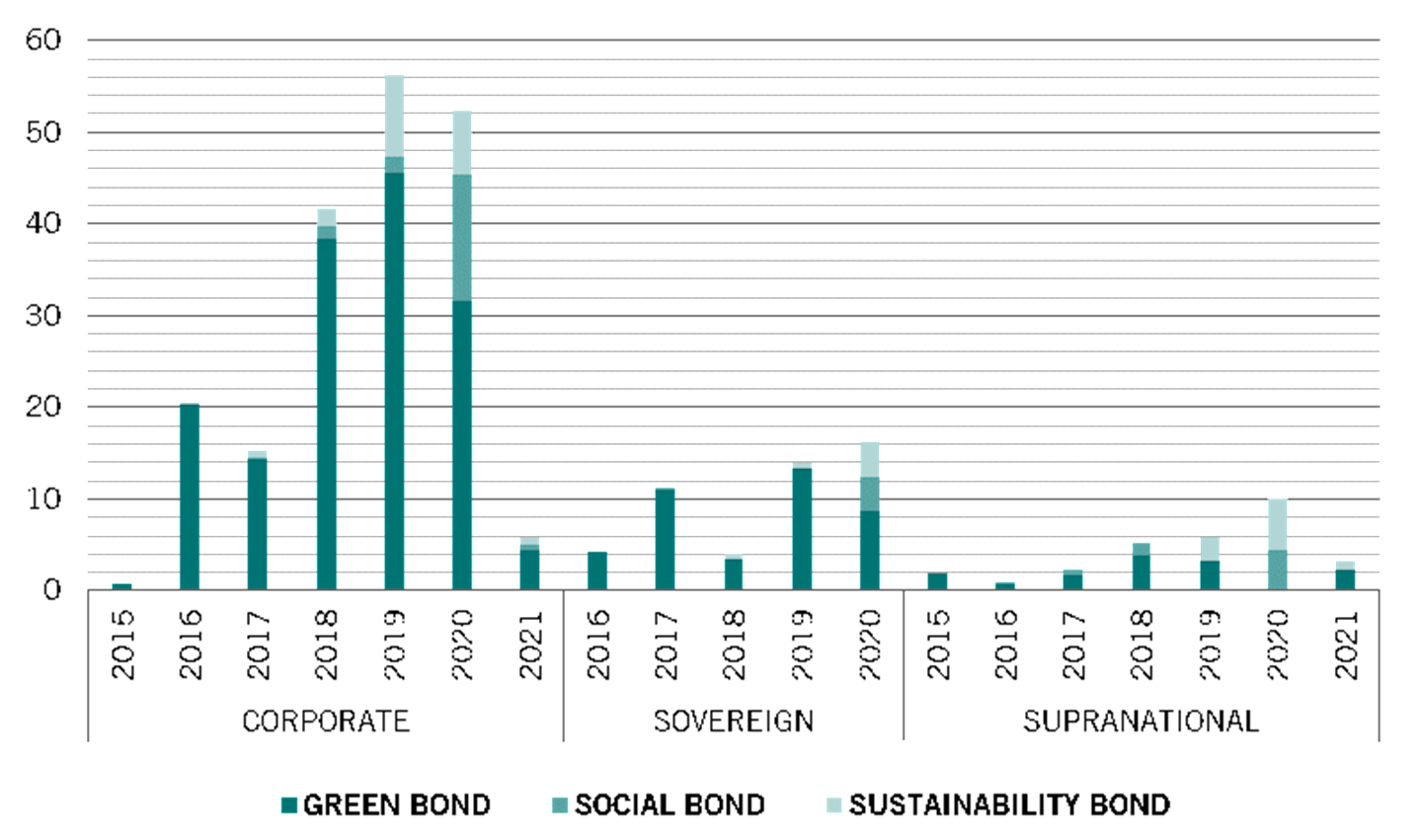

Fig. 1 - Borrowing sustainably

Emerging markets Green, Social and Sustainability bond issuance by type (USD bn)

Source: Pictet Asset Management, Bloomberg. Data as at 22.01.2021.

Source: Pictet Asset Management, Bloomberg. Data as at 22.01.2021.

In the five years to the end of 2020, annual issuance of green, social and sustainability bonds by emerging market governments grew nearly four-fold to USD16.2 billion. And demand is only increasing. For instance, in the first few weeks of January, Chile met 70 per cent of its expected USD6 billion debt issuance for 2021, all in green and social bonds and it plans only to issue sustainable and green bonds during the remainder of the year. In September 2020, Egypt became the first Middle Eastern government to issue a green bond. It raised USD750 million to finance or refinance green projects. Investors were enthusiastic – the bond was five times oversubscribed.

And generally, these bonds have longer maturities than conventional fixed income securities. Some 46 per cent of USD36.8 billion of outstanding emerging market ESG bonds priced in local currency terms have a maturity of more than 10 years, while for emerging markets hard currency ESG bonds, it’s 41 per cent of USD12.9 billion of outstanding bonds.

These bonds allow investors to track performance, while green agendas can also help governments to improve their credit ratings, which then lifts the value of their debt, thus rewarding bond holders.

Overall, green bonds generate positive feedback effects. The rising volumes of green and sustainable bond issuance highlights investors' willingness to take more of a long-term approach to EM investing. But at the same time, governments are being made more accountable – in order to issue these bonds, governments are having to publish their sustainability frameworks in greater detail. This additional accountability helps to mitigate political risks that are a key consideration in EM investing. Investors, however, will need to analyse and monitor developments closely to ensure proceeds are used as intended.

Indeed, green bonds are the most exciting development in emerging market financing for decades and, we think, will have an equivalent impact to the Brady bonds of the 1980s6 – albeit this is dependent on improved disclosure and monitoring and industry standardisation of green labels.

[1] JPM EMBI-GD and GBI-EM. Data as at 25.01.21.

[2] Ibid

[3] https://www.latinfinance.com/daily-briefs/2021/1/22/interview-chile-diversifies-investor-base-with-esg-bonds

[4] https://www.reuters.com/article/egypt-bonds-int-idUSKBN26K1MJ

[5] Source: Pictet Asset Management, Bloomberg. Data as at 25.01.21

[6] Brady bonds were an innovative debt reduction programme in response to the Latin American debt crisis of the 1980s, involving the issuance of US dollar denominated bonds.

For all the sovereign issuance of green bonds so far, a great deal more funding will need to be raised to limit climate change. Globally it will cost between USD1 trillion and USD2 trillion a year in additional spending to limit global warming, some 1 per cent to 1.5 per cent of worldwide GDP, according to the Energy Transitions Commission. And a significant part of those costs will need to be borne by emerging economies, not least because they are likely to suffer most.

By the end of this century, unmitigated climate change – entailing warming of 4.3° centigrade above pre-industrial levels – would cut per capita economic output in major countries like Brazil and India by more than 60 per cent compared to a world without climate change, according to a report by Oxford University’s Smith School sponsored by Pictet. Globally, the shortfall would be 45 per cent.

Fig. 2 - Showing their maturity

ESG bonds maturity profile (USD bn)

Source: Pictet Asset Management, Bloomberg. Data as at 22.01.2021.

Limiting warming to 1.6° C would sharply reduce that hit to roughly 27 per cent of potential output per capita for the world as a whole, albeit with considerable variation among countries. While those in the tropics countries would be hit hard by the effects of drought and altered rainfall patterns, those in high latitudes, like Russia, would be relative winners as ports become less ice-locked and more territory is opened up to extractive industries and agriculture. And though China would suffer smaller overall losses than average, its large coastal conurbations would be subject to depredations caused by rising sea levels.

[7] https://www.reuters.com/article/uk-energy-transition/global-net-zero-emissions-goal-would-require-1-2-trillion-a-year-investment-study-idUKKBN2670OA?edition-redirect=in

[8] Hepburn, C. et al. “Climate Change and Emerging Markets after Covid-19.” November, 2020. Estimates based on the Intergovernmental Panel on Climate Change’s shared socioeconomic pathway 2 (SSP2) using cmip5 climate models.

As these effects are felt, investors will grow increasingly wary of lending to vulnerable countries. And climate change is already having an impact on developing countries’ credit ratings. In 2018, rating agency Standard & Poor’s cited hurricane risk when it cut its ratings outlook on the sovereign debt issued by the Turks and Caicos.

Investors could expect climate-related events, like droughts, severe storms and shifts in precipitation patterns, to push up output and inflation volatility in emerging economies during the next ten to 20 years, according to Professor Cameron Hepburn, lead author of the Oxford report.

That would represent a significant reversal for emerging market sovereign borrowers. Since the turn of the century the relative rate of growth and inflation volatilities between emerging and developed markets has halved, which, in turn, has reduced the risk faced by investors. Rising economic volatility would feed into sovereign risk assessments, eroding their credit profiles.

Climate change is already having an impact on developing countries' credit rating.

Other research from the Oxford team highlights the choices countries will need to take to remain on the path towards building a greener economy.

At Pictet Asset Management, we already use a wealth of ESG data – from both external and internal sources –as part of how we score countries. The environmental factors we monitor include air quality, climate change exposure, deforestation and water stress. Social dimensions include education, healthcare, life expectancy and scientific research. And governance covers elements like corruption, electoral process, government stability, judicial independence and right to privacy. Together these factors are aggregated to become one of six pillars in the country risk index (CRI) ranking produced by our economics team.

[9] https://www.spglobal.com/marketintelligence/en/news-insights/trending/vep0j9mtowo52rlsmmww9g2#:~:text=S%26P%20Global%20Ratings%20revised%20its,two%20major20major%20hurricanes%20last%20year.&text=S%26P%20expects%20real%20GDP%20to,average%20from%202019%20to%202021.

[10] Average of rolling 2-year standard deviation of growth and inflation rates for 27 EM countries relative to 25 DM countries. Source: Pictet Asset Management, CEIC, Refinitiv. Data 01.01.2000 to 01.01.2021.

[11] https://www.researchgate.net/publication/340509193_Economic_complexity_and_the_green_economy

We believe that ESG considerations are inefficiently reflected in emerging market asset prices. This is a consequence of the market still being at an early stage in its understanding and application of ESG factors and analysis. There is also a lack of consistent and transparent ESG data for many emerging countries. We believe that using an ESG score alone is simply not enough. Having a sustainable lens through which to examine emerging market fundamentals helps us to mitigate risk and unearth investment opportunities. We use our own ESG data and analysis and engage with sovereign bond issuers to help bring about long-term change.

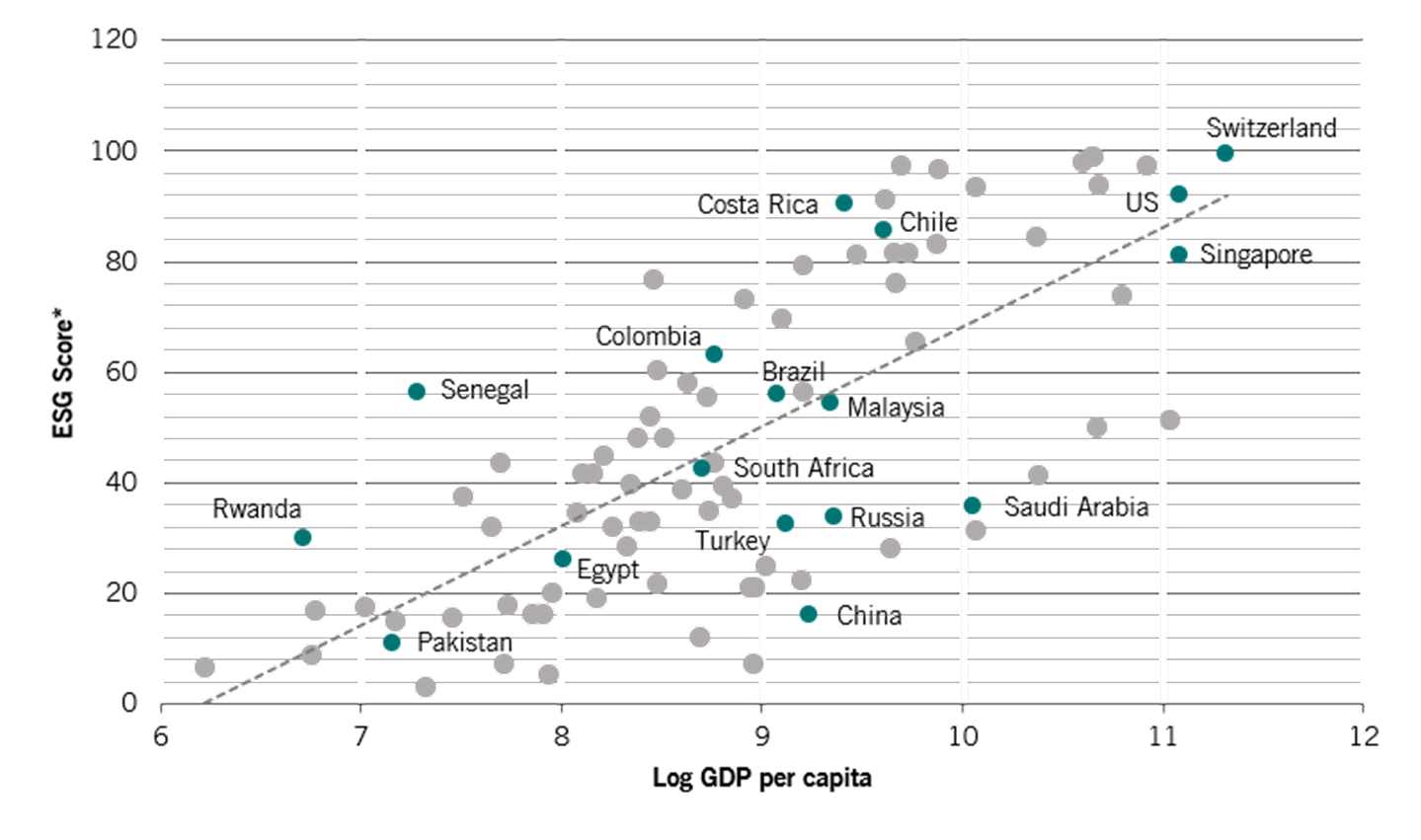

Emerging market economies vary hugely in their degree of development. This complicates how investors should weigh their ESG performance – after all, richer countries are more able to make the ESG-positive policy decisions that often have high front end costs for a long tail of benefits, such as shutting down coal mines in favour of solar power.

Fig. 3 - GDP vs ESG

Country GDP per capita compared to ESG scores

*ESG score is transformed from Maplecroft data. Trendline R-squared is 0.52. Source: Maplecroft, Bloomberg, Pictet Asset Management. Data as at 31.12.2020.

*ESG score is transformed from Maplecroft data. Trendline R-squared is 0.52. Source: Maplecroft, Bloomberg, Pictet Asset Management. Data as at 31.12.2020.

Applying the most simplistic approach to ESG – investing on the basis of countries' ESG rankings – would squeeze fixed income investors out of the poorest developing countries, even if they are implementing the right policies to improve their ESG standing. Instead, it’s important for investors to recognise what is possible and achievable by poorer countries and allocate funding within those constraints – understanding countries’ direction of travel in terms of ESG is critical to analysing their prospects.

One solution we are implementing at Pictet AM is to weigh ESG criteria against a country’s GDP per capita. So, for example, under our new scoring system, Angola does well on this adjusted basis despite having a low overall ranking. And the reverse is true for Gulf Cooperation Council member states.

How governments react to long-term issues like climate change or to the challenge of developing their human capital will influence their economies’ trajectories and, ultimately, play a role in their credit ratings. Those long-term decisions are only growing in importance, not least given the scale of fiscal policies implemented in the wake of the Covid-19 pandemic. Tracking these spending programmes – through, say, the likes of the Oxford Economic Stimulus Observatory – then becomes an important step towards understanding the ESG pathways governments are likely to follow.

Countries with good, well-structured policies are likely to see their credit ratings improve, which attracts investors, drawing funding into their green investment programmes and ultimately driving a virtuous investment cycle.

[12] https://www.ouerp.com/totaltracking

All this implies that investors have an active role to play – they can’t just passively allocate funding based on index weightings or be purely reactive to policymakers’ decisions. The most successful investors will help steer governments towards the path that boosts their credit ratings, gives them most access to the market and improves the fortunes and potential of citizens.

Like, for instance, explaining how electricity generated by wind turbines or solar can prove to be more cost-effective over the long term if financed by green bonds than ostensibly cheaper coal extracted from a mine paid for with higher yielding conventional debt. Or how fossil fuel investments could prove to be major white elephants as these sorts of polluting assets become stranded by shifts towards cleaner energy production. Or that failing to invest enough in education is a false economy that over the long run will fail to make the most of human capital and thus depress national output – something we raised with the South African government after our meetings with our on-the-ground charitable partners in the country.

To that end, The World Bank produced in 2020 a timely guide on how sovereign issuers can improve their engagement with investors on ESG issues.

The most successful investors will help steer governments towards the path that boosts their credit ratings.

This sort of intensive analysis – using everything from long run macro models down to meetings with leaders of youth clubs in impoverished districts – can also help to paint a rounded picture of what’s happening in a country. For instance, it helped to ensure that we weren’t caught off guard by the shift to populism in Argentina ahead of their last elections and allowed us to trim our positions in the country.

For emerging market investors, ensuring all of these cogs mesh correctly is a difficult proposition, especially given that the parts are moving all the time, many driven by forces that will develop over many decades. But by using the full breadth of analytical tools, independent research and shoe leather fact-finding, it’s possible to gain a deeper and more profitable insight into these markets than a simple reading of credit ratings or index weightings offers. And, at the same time, influence policy makers to champion their country’s sustainable initiatives. Taking a sustainable approach to growth and issuing related bonds, emerging economies can fundamentally change their prospects for the better. It has the potential to be revolutionary for emerging markets and exhilarating for those of us who invest in them.

[13] https://www.worldbank.org/en/news/press-release/2020/11/08/world-bank-releases-guide-for-sovereign-issuers-to-engage-with-investors-on-environmental-social-and-governance-esg-issues

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to risks and uncertainties that could cause actual results to differ materially from those presented herein.

This marketing document is issued by Pictet Asset Management. It is neither directed to, nor intended for distribution or use by any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. Only the latest version of the fund’s prospectus, the KIID (Key Investor Information Document), regulations, annual and semi-annual reports may be relied upon as the basis for investment decisions. These documents are available on assetmanagement.pictet.

This document is used forinformational purposes only and does not constitute, on Pictet Asset Management part, an offer to buy or sell solicitation or investment advice. It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date. The effective evolution of the economic variables and values of the financial markets could be significantly different from the indications communicated in this document.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Pictet Asset Management has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested. Risk factors are listed in the fund’s prospectus and are not intended to be reproduced in full in this document. Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares. This marketing material is not intended to be a substitute for the fund’s full documentation or for any information which investors should obtain from their financial intermediaries acting in relation to their investment in the fund or funds mentioned in this document.

EU countries: the relevant entity is Pictet Asset Management (Europe) S.A., 15, avenue J. F. Kennedy, L-1855 Luxembourg. Switzerland: the relevant entity is Pictet Asset Management SA , 60 Route des Acacias – 1211 Geneva 73. Hong Kong: this material has not been reviewed by the Securities and Futures Commission or any other regulatory authority. The issuer of this material is Pictet Asset Management (Hong Kong) Limited. Singapore: this material is issued by Pictet Asset Management (Singapore) Pte Ltd. This material is intended only for institutional and accredited investors and it has not been reviewed by the Monetary Authority of Singapore. For Australian investors, Pictet Asset Management Limited (ARBN 121 228 957)

is exempt from the requirement to hold an Australian financial services license, under the Corporations Act 2001. For US investors, Shares sold in the United States or to US Persons will only be sold in private placements to accredited investors pursuant to exemptions from SEC registration under the Section 4(2) and Regulation D private placement exemptions under the 1933 Act and qualified clients as defined under the 1940 Act. The Shares of the Pictet funds have not been registered under the 1933 Act and may not, except in transactions which do not violate United States securities laws, be directly or indirectly offered or sold in the United States or to any US Person. The Management Fund Companies of the Pictet Group will not be registered under the 1940 Act. Pictet Asset Management Inc. (Pictet AM Inc) is responsible for effecting solicitation in North America to promote the portfolio management services of Pictet.