You are using an outdated browser. Please upgrade your browser to improve your experience.

Article | 08 December 2021 | Investments

2021 was the year of the vaccine and the bottleneck. Economies gained strength as vaccine programmes were rolled out, while global supply chains seized up and an acute shortage of semiconductors held back manufacturing. And rising demand pushed price inflation higher. We present the pick of the Quick Looks as the year unwound.

Joe Biden was safely inaugurated as 46th president of the US. His new Treasury Secretary, who will control the finances, is a familiar figure. Janet Yellen was formerly Chair of the US Federal Reserve (Fed), where she oversaw years of easy interest rate policy. But she also called for bolder action on government stimulus. No surprise then that she now recommends Biden should ‘act big’ in boosting the recovery. The president duly launched the first part of his American Recovery Plan, a $1.9 trillion package focusing on families and Covid-19 vaccinations.

The aftershocks of pandemic trade disruption rolled on. Car production was hit by an acute shortage of semiconductors or semis. Factories in China, Japan, the US and Europe stood idle, waiting for deliveries. The semis may be small, but they’re essential for everything from automatic braking systems to airbags and electronic seats. Analysts estimate lost production could total 1.5 million vehicles. It seems car manufacturers misjudged the rebound in demand last summer, cancelling orders. The semis were sucked up by the booming consumer goods industry. And lead times now stretch to six months.

The US Federal Reserve (Fed) took no action, despite the twin issues of rising bond yields and inflation that have historically triggered interest rate hikes. What has turned the heat up under the Fed? President Biden’s $1.9 trillion recovery stimulus was barely passed into law before plans fired up for a $3 trillion infrastructure package. And the target of 100 million Covid-19 vaccinations was hit in half the promised time. Both could fuel an overheating economy. But the Fed’s president remained cool, predicting a brighter economic outlook and interest rates locked close to zero.

Joe Biden completed his first hundred days as president of the United States. The milestone was first flagged by President Franklin D Roosevelt, elected during the Great Depression on a pledge to help the American people. Many of Biden’s early promises have been delivered, and at an extraordinary pace. From the immediate re-joining of the Paris Agreement on climate change to the $1.9 trillion stimulus package dubbed the ‘American Rescue Plan’; and from the double-time rollout of Covid-19 vaccines to a proposed $2.2 trillion infrastructure plan. Biden has embraced the challenge to ‘act big’.

As prices touched new highs on the EU Emissions System, Brexit forced the UK to launch its own carbon credit market. Prices opened at a significant premium to those across the Channel, meaning higher costs for the UK’s big polluters. And bigger profits for companies with strong green credentials, who can sell on their carbon credits. Meanwhile Stellantis, the car giant formed by the merger of Chrysler, Fiat and Peugeot, announced it would no longer need to buy carbon credits from Tesla, given the carbon credits earned from their own focus on electric vehicles.

The G7 group of nations has agreed a deal for a global minimum tax rate of at least 15%. The new rules will see the largest and most profitable companies paying tax in the countries where they do business, not just where they are registered. This could spell the end of the inventive tax strategies employed by many multi-national companies, such as diverting profits to offshore tax havens. But before coming into effect, the deal needs further backing. Not only the G20 nations, but also the 139 countries of the OECD will have to approve.

A key challenge for global central banks remains the sharp spike in inflation. Driven by used cars, travel and lodging, US inflation shot up by 5.4% in June. That’s the highest for 13 years. If higher inflation takes hold, the US Federal Reserve might have to act aggressively to slam the overheating economy into reverse. It’s described by a Bank of England economist as an ‘economic handbrake turn’. The head of Germany’s Bundesbank warned against discounting inflation as a risk. He recalled the Galapagos giant tortoise, which reappeared despite having been classed as extinct for 100 years.

BHP, the world’s biggest mining company, is selling its oil and gas division, following shareholder pressure to decarbonise its activities. Oddly, as the acquisition will be paid for in shares, BHP will still own these activities, only indirectly. So are these disposals by major energy and natural resource companies all about the optics? There are concerns that smaller, perhaps less accountable, operators might be tempted to run these assets into the ground, risking greater environmental damage. Activists believe the major players would do better to manage the winding down of these operations themselves.

Evergrande, the giant property developer, became the latest high-profile casualty of China’s government clampdowns. Property speculation sits firmly in the sights of President Xi, in his bid to stamp out extreme wealth for the few and promote ‘common prosperity’ in China. As the world’s most indebted property company, Evergrande faced a crisis as interest payments fell due. Markets were shaken, as the property sector represents as much as 28% of China’s economy. Meanwhile, oversupply remains an issue. Around 90 million apartments stand empty in China, enough to house the entire population of several G7 countries.

The UN Conference on Climate Change, or COP26, began in Scotland, attended by leaders of almost 200 countries from across the world. There were notable absences, namely the presidents of China and Russia, who together produce a third of global emissions. Plans for achieving net zero emissions by mid-century will focus on phasing out coal, ending deforestation, promoting the use of electric vehicles and developing renewable energy technologies. Meanwhile, at the Youth4 Climate meeting, teenage activist Greta Thunberg called for action after ‘thirty years of blah, blah, blah’.

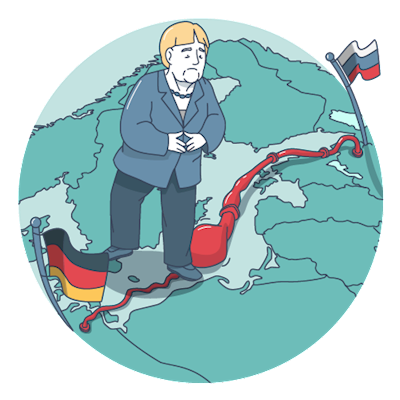

Gas prices leapt again in Europe, touching €100 per megawatt hour, as Germany halted approval of the Nord Stream 2 pipeline. That compares with €64 a week earlier. The oil price, meanwhile, steadied around $80 per barrel, anticipating a release from the US Strategic Petroleum Reserve. In the end, the 50 million barrels released, about half the daily amount used globally, were not enough to cap off the rally, and the oil price bounced. Allowing President Biden to call this rise a threat to global recovery, as inflation proves anything but ‘transitory’.

As 2021 comes to a close, familiar stories continue to grip the markets. The Covid-19 pandemic, a surge in inflation and Big Tech still dominate. As well as a new urgency to address climate change. The start of the coming year could bring more data on rising prices and wages. The response of the world’s central banks will likely drive financial markets. Only time can tell how these events will play out. In the meantime, we wish all our readers a happy and successful 2022!