You are using an outdated browser. Please upgrade your browser to improve your experience.

Article | 24 November 2021 | Investments

There are two quotations that I always think are worth bearing in mind when it comes to investing. The first, from US economist Harry Markovitz, is that “diversification is the only free lunch”.

Diversifying a portfolio helps to reduce volatility and build out returns. It’s unrealistic to expect everything in a diversified portfolio to perform well at the same time; indeed, you wouldn’t want it to as this would suggest it wasn’t truly diversified.

Instead, a diversified portfolio should both achieve your returns target and smooth out the returns profile. As markets evolve, there should always be something in the portfolio that is doing well.

The second quotation - “Compound interest is the eighth wonder of the world. He who understands it earns it; he who doesn't, pays it” - is by Albert Einstein.

Compounding is the art of building returns on returns. There are really only two ways to generate returns. The first is to take large “bets” and hope they pay off. The second is to take smaller bets and reinvest the returns they make, thereby enabling those returns to create their own returns. This approach takes time but is generally less volatile and involves less portfolio turnover.

These points are particularly important for investors who not only have a return goal in mind, but who care about the consistency of how those returns are achieved.

The concept behind a multi-strategy fund is to combine a wide array of uncorrelated strategies, thereby achieving diversification benefits. The compounding element comes from the selection of those strategies.

Investors can potentially also increase their diversification by taking a market neutral approach as well. Equity market neutral strategies aim to offer positive returns regardless of whether equity markets are rising or falling. They achieve this by having low net exposure to the market and focusing on the returns of long and short positions within a portfolio.

Minimising the impact of broad stock market moves enables greater diversification because the idiosyncratic alpha being generated by individual strategies is not overwhelmed by market movements.

From a diversification perspective, there are three stages to this:

1. Traditional portfolio construction – diversification of stocks

2. Add more strategies

3. Neutralise market

The crucial point in terms of diversification is not only to add more strategies but to ensure that these are not correlated to each other. This means selecting strategies that are diversified by geography, sector, market cap, style, etc.

An advantage of choosing a multi-strategy approach, as opposed to simply holding various individual funds, is that the multi-strategy managers will consider the portfolio as a whole and take steps to ensure returns are uncorrelated.

For example, it is perfectly possible to hold funds that superficially appear to be diversified, in that they may invest in different regions or have different sector biases, only to find that in fact they perform exactly the same way. A multi-strategy investor will seek to construct the overall portfolio so as to avoid this risk, hedging out any unintended skews that may result from the combination of the underlying strategies.

It’s important to stress here that simply adding more strategies is not a sure-fire way to achieve diversification; what matters is how they are put together and what each individual strategy brings to the whole.

There may well come a point where adding new strategies doesn’t bring anything new to the overall portfolio. Trying to manage too many strategies may also negatively impact the portfolio manager’s ability to stay abreast of the details. The optimal number of strategies will vary but around 25 appears to be a sweet spot.

Meanwhile, the benefits of this diversification are most likely to be seen by taking a “slow and steady” approach and allowing time for compounding to do its work. Essentially, building a multi-strategy portfolio is about bolting together numerous reasonable and predictable streams of returns, rather than trying to pick the top performer at any given time.

It is, in short, about time in the market, rather than timing the market. However, like the tortoise in the fable whose steady progress eventually beats the fast-starting hare, a multi-strategy approach can still deliver an attractive return.

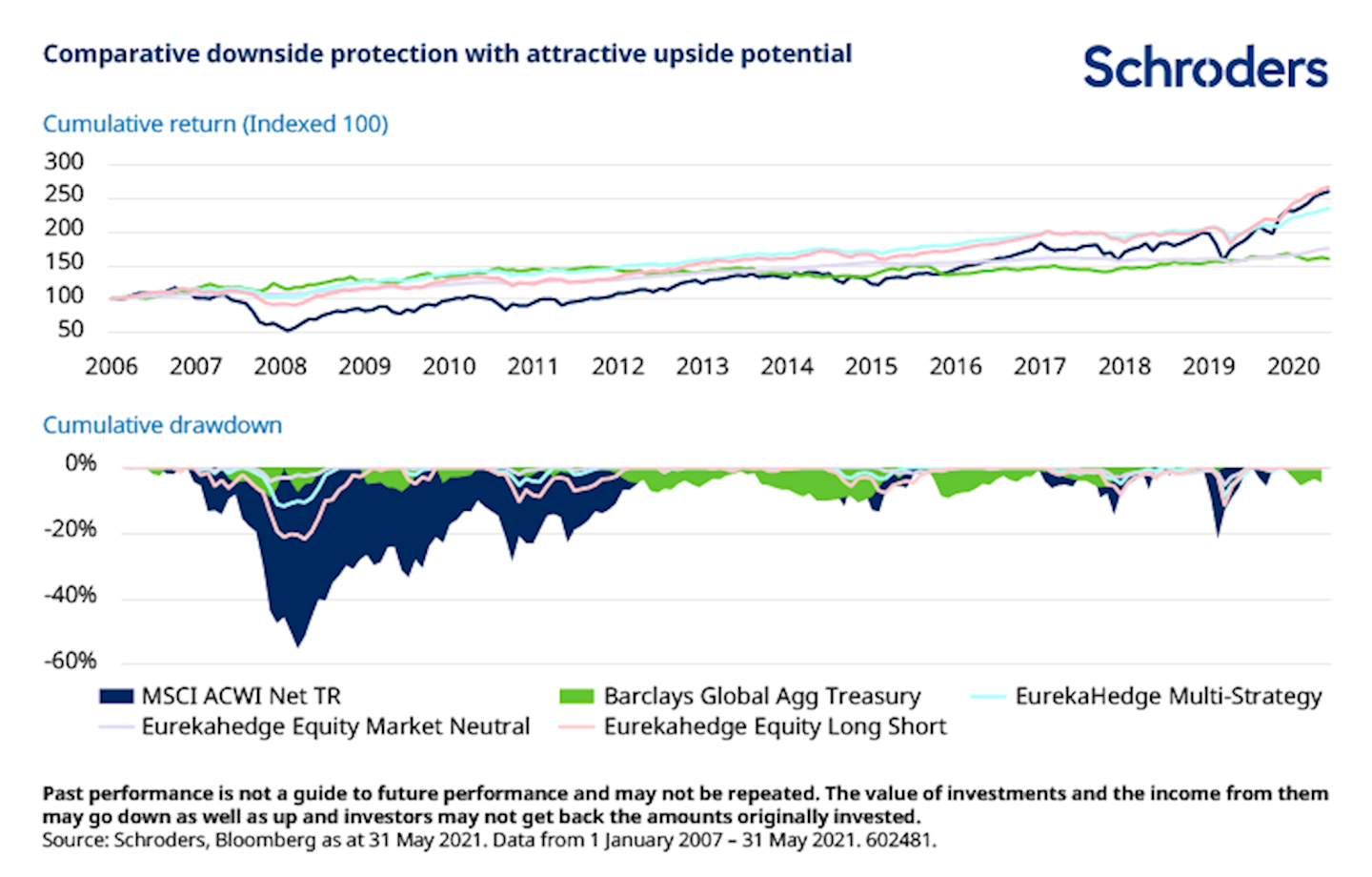

Their diversification and lack of correlation to broader markets means that both multi-strategy and market neutral approaches have a cumulative returns profile that historically is comparable to equities but with superior protection against drawdowns, as the charts below show.

Why does this matter now?

Steady, reliable returns that are not dependent on broader market moves will always hold an attraction for many investors. However, the present moment might be one when more investors could consider the option of a multi-strategy, market neutral approach.

It’s no secret that equity markets have been very strong in recent years, but can we rely on that continuing? There are a number of reasons to think that depending on market beta for strong returns may not work so well in the coming years. Both corporate earnings and multiples may be at risk.

Firstly, while corporate earnings this year have rebounded strongly from the lockdown-hit 2020, the outlook for 2022 earnings seems more challenging. Issues such as supply chain disruption, rising inflation, the need for governments to raise taxes to pay for pandemic spending, and possible economic scarring could combine to drag on corporate profits.

Secondly, the prospect of further multiple expansion also looks more challenging. Stimulus from central banks is largely exhausted and asset purchases will start being tapered soon, particularly by the Federal Reserve. Rising inflation could lead to interest rate rises, which could prompt a change in equity market leadership.

In such an environment, investors may prefer to seek out diversified sources of alpha rather than depending on market returns.

Important information:

Marketing material for professional clients only. Investment involves risk. Any reference to sectors/countries/stocks/securities are for illustrative purposes only and not a recommendation to buy or sell any financial instrument/securities or adopt any investment strategy. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on any views or information in the material when taking individual investment and/or strategic decisions. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of investments to fall as well as rise. Schroders has expressed its own views and opinions in this document and these may change. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Insofar as liability under relevant laws cannot be excluded, no Schroders entity accepts any liability for any error or omission in this material or for any resulting loss or damage (whether direct, indirect, consequential or otherwise). This article may contain ‘forward-looking’ information, such as forecasts or projections. Please note that any such information is not a guarantee of any future performance and there is no assurance that any forecast or projection will be realised. This material has not been reviewed by any regulator.