You are using an outdated browser. Please upgrade your browser to improve your experience.

Article | 23 November 2022 |

Since 1929, every downturn in the S&P 500 of 15% or more has been followed by a recovery – with an average first-year return of 55%. When looking at recovery periods, it’s important to remember that they follow historical declines. Staying invested, and not moving into cash, allows investors to benefit from any recovery and may better help them achieve their financial goals in the long term.

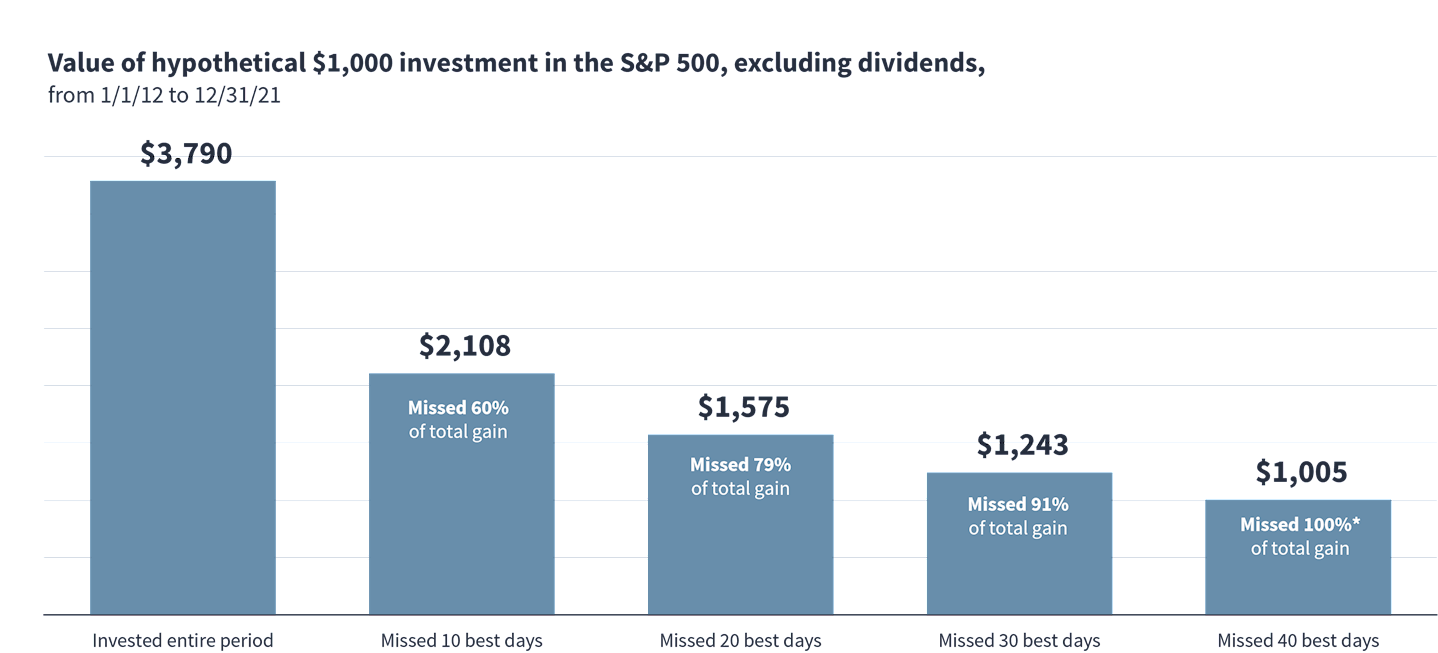

Capturing the best days

Investors who fail to get back into the market at the right time can miss out on the full benefit of market recoveries, and the more missed days an investor accumulates, the steeper the overall losses can be. For example, by not capturing the 10 best days, an investor would be missing out on 60% of the total gain. This percentage difference increases the more days are missed, so that by not capturing the 30 best days, an investor would be missing out on 91% of total gain. The more days missed, the steeper the losses can be.

Looking to the long term

Historically, if an investor held stocks for just one year, they would have lost money 27% of the time. By extending that holding period to ten years, they would have experienced losses just 6% of the time. By sticking to investment plans through market highs and lows, there is a higher chance that investors are more likely to come out ahead over the long term, increasing their chances of generating positive returns.

It’s worth remembering that in real (inflation-adjusted) terms, stock markets have consistently been positive over the long term.