You are using an outdated browser. Please upgrade your browser to improve your experience.

Article | 25 March 2021 | Investments

Confidence in a post-pandemic recovery is growing, boosted by vaccines and stimulus packages. This optimism over the reopening of the world’s economies could result in above average growth for the next few years. Along with this, expectations have been building for a pick-up in inflation. And that has been enough to rattle financial markets. We take a closer look at the consequences of rising inflation, a topic which could dominate investment headlines for the year ahead.

Central bank QE or bond buying programmes have kept bond prices supported and yields at record lows since then. A huge number of bonds, $18 trillion worth at the end of 2020, even have a yield below 0% or a negative yield. Over the same period, inflation was also dormant, so all was good. But the unprecedented level of fiscal or government stimulus we have seen since the Covid-19 pandemic struck, is likely to boost demand sharply.

This type of stimulus has a more direct impact on consumers’ spending power, meaning everyday prices could start to rise. As February closed, financial markets started to take inflation seriously.

Date: 22.03.2021

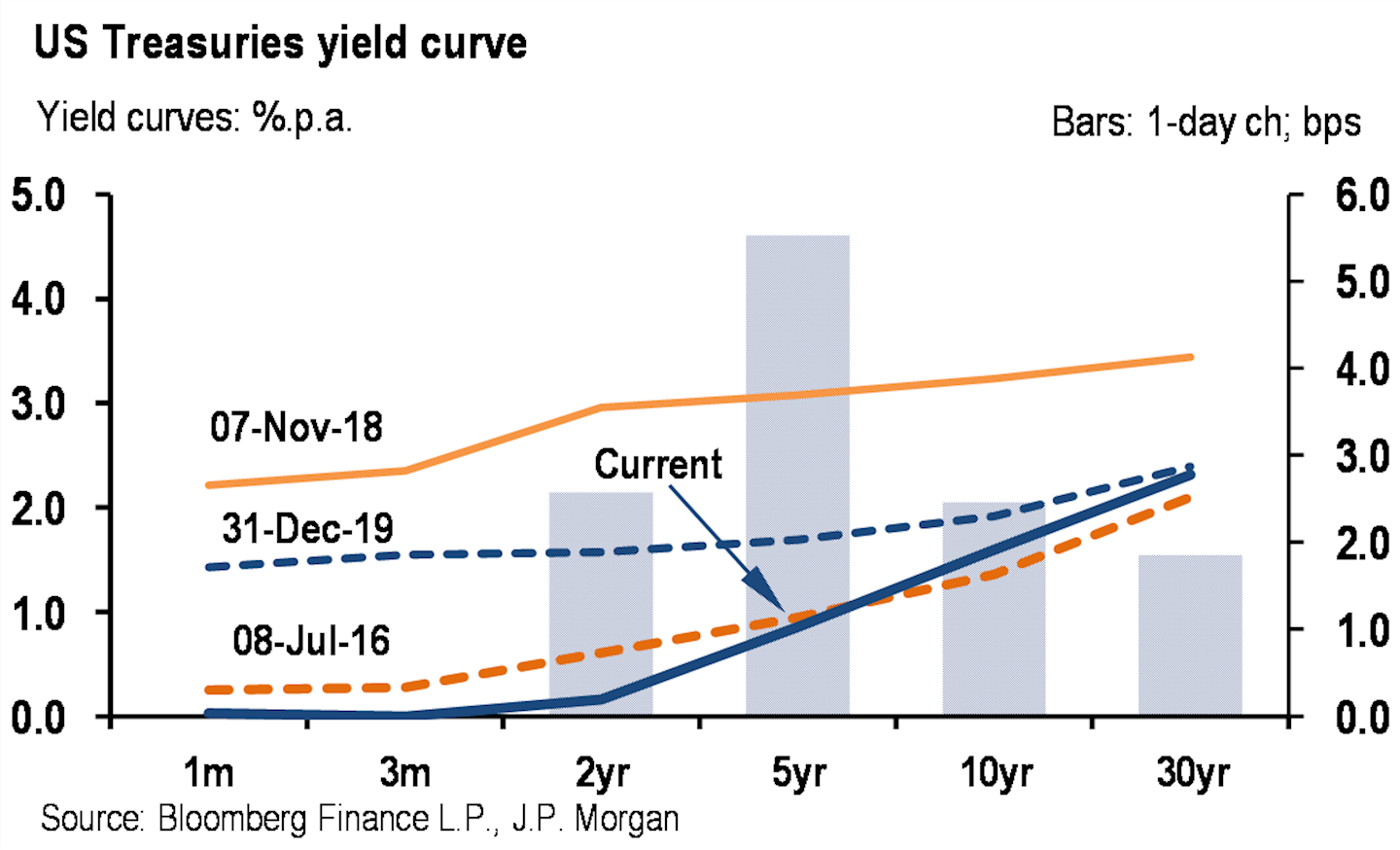

A steeper curve, just as we have currently, indicates the bond market’s conviction of a higher rate of interest in the future. A higher rate of inflation normally requires higher interest rates in the economy. For bonds that means higher yields, compensating for the negative effect of inflation on income. As bond yields rise their prices fall. And as the longer dated bond yields are rising faster, as shown by this steeper curve, their prices are falling faster.

A steady increase in inflation implies growth in the economy, with rising demand, employment and consumer spending. It’s preferable to deflation, which has the opposite effect. Growing demand allows companies to raise prices, increase profits and pay higher dividends. This is particularly true of cyclical companies, whose earnings are heavily dependent on economic growth. The problem comes with very high growth companies, whose best years of dividend payment are some way in the future. Financial markets use a yardstick based on longer term bond yields in order to value them. If those yields go up, then the potential future value of the company is adjusted downwards. And that’s why the tech heavyweights in the US and China have fallen sharply.

Architas view

While the bond markets are currently nervous about rising inflation, it’s not always a one-way bet.

Commodity prices, such as oil and copper may be on the rise, but other important indicators have barely moved. It is also worth noting that inflation expectations can differ widely across the globe, depending on local conditions. And that what is troubling for bonds might be very positive for different types of asset classes or regions. As ever in times of heightened volatility, a diversified portfolio can help to weather the market ups and downs.