You are using an outdated browser. Please upgrade your browser to improve your experience.

Article | 29 September 2021 | Investments

As the major economies have pledged one by one to achieve net zero emissions of carbon (NZE) within decades, shareholders have put pressure on the world’s biggest fossil fuel companies to move in the same direction. It’s perhaps a tall order when your main business is hydrocarbons, but a number of Big Oil companies have embraced the challenges of a transition to sustainable energy production. At least that is the message they convey. We take a look at the timely switch from ‘brown’ to ‘green’ energy and some possible unintended consequences.

First let’s consider the issues faced by the energy ‘supermajors’.

So how should the supermajors move forward? Divestment of energy production assets looks like an easy win. US and European energy companies have made disposals worth $28 billion since 2018. And in order to keep up with shareholder pressure, a further $140 billion of assets is slated for disposal, often with a view to investing the proceeds in greener energy solutions. As an example, Shell recently announced the $9.5 billion sale of its business in the Permian Basin, the largest oilfield in the US. Alongside this the company revealed a plan to install 50,000 on-street charging devices, securing a third of the electric vehicle charging market, in the UK. So far, so good.

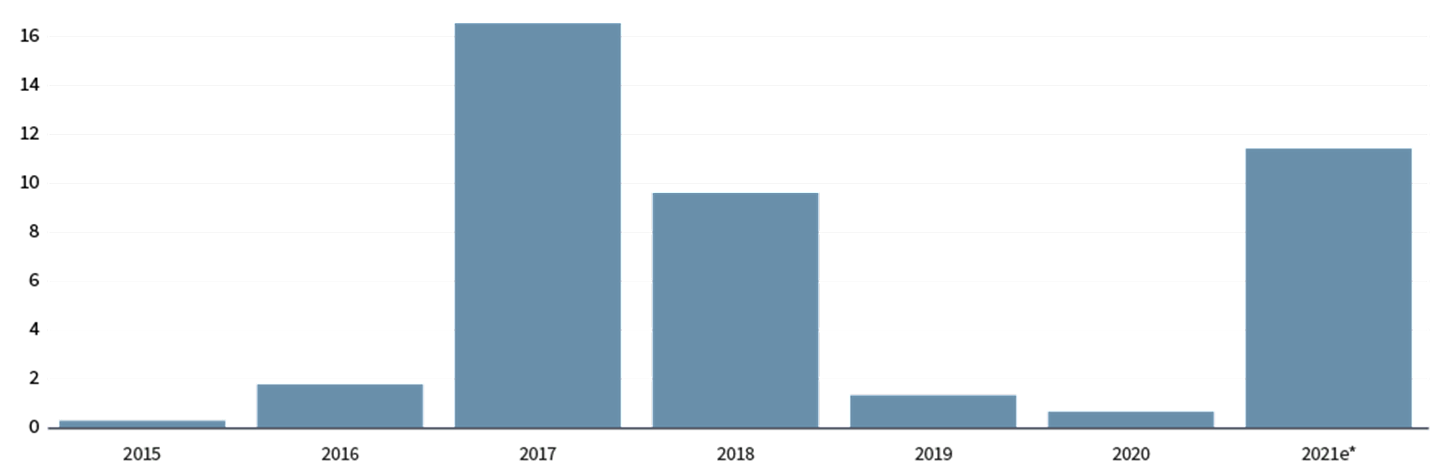

Value of exploration and production assets sold ($ billion)

*estimated data include $9.5 billion disposal in September 2021

But appearances can be deceptive. Recent deals in the sector, including disposals and new joint ventures, might simply result in taking these assets off Big Oil’s balance sheet, giving a ‘cleaner and greener’ look when viewed through the NZE lens. And the new owners might not be best suited for these assets, as they are likely planning to extract every last drop of hydrocarbon in an unsustainable way. Indeed, the supermajors have been advised that they would themselves be the best and most responsible operators of these assets to the end of their useful life. So is it all about the optics? And could hasty disposals, aimed at slashing emissions, even verge on greenwashing?

Architas view

The price of oil has rebounded this year, on hopes of a post-pandemic resurgence in demand. Big Oil is awash with cash from operations, as well as from asset disposals. Alongside investments in sustainable energy technology, they have been using this cash to make share buybacks and ramp up dividends, in the hope of restoring their place in investors’ good books. Yield hungry investors have been happy to receive this dependable source of income.

It’s worth noting that a story which might seem troubling for a specific equity sector, might offer a silver lining for other sectors or investors. As ever in uncertain times a diversified portfolio, covering a broad range of sectors and asset classes, can help to weather any tricky market trends.