You are using an outdated browser. Please upgrade your browser to improve your experience.

Article | 26 September 2021 | ESG

Our decisions are often a product of our environment. Rarely is it the case that any single decision we make in our lives is based purely on only one influence. This is particularly the case for major financial decisions – how we choose to invest, purchase a house or purchase a car are all influenced by a variety of people, information and media.

We might say that making an investment is slightly different to buying a house or a car and, of course, they are not exactly the same. That said, they are all major financial decisions that people make based on the (conscious or subconscious) sum of those influences.

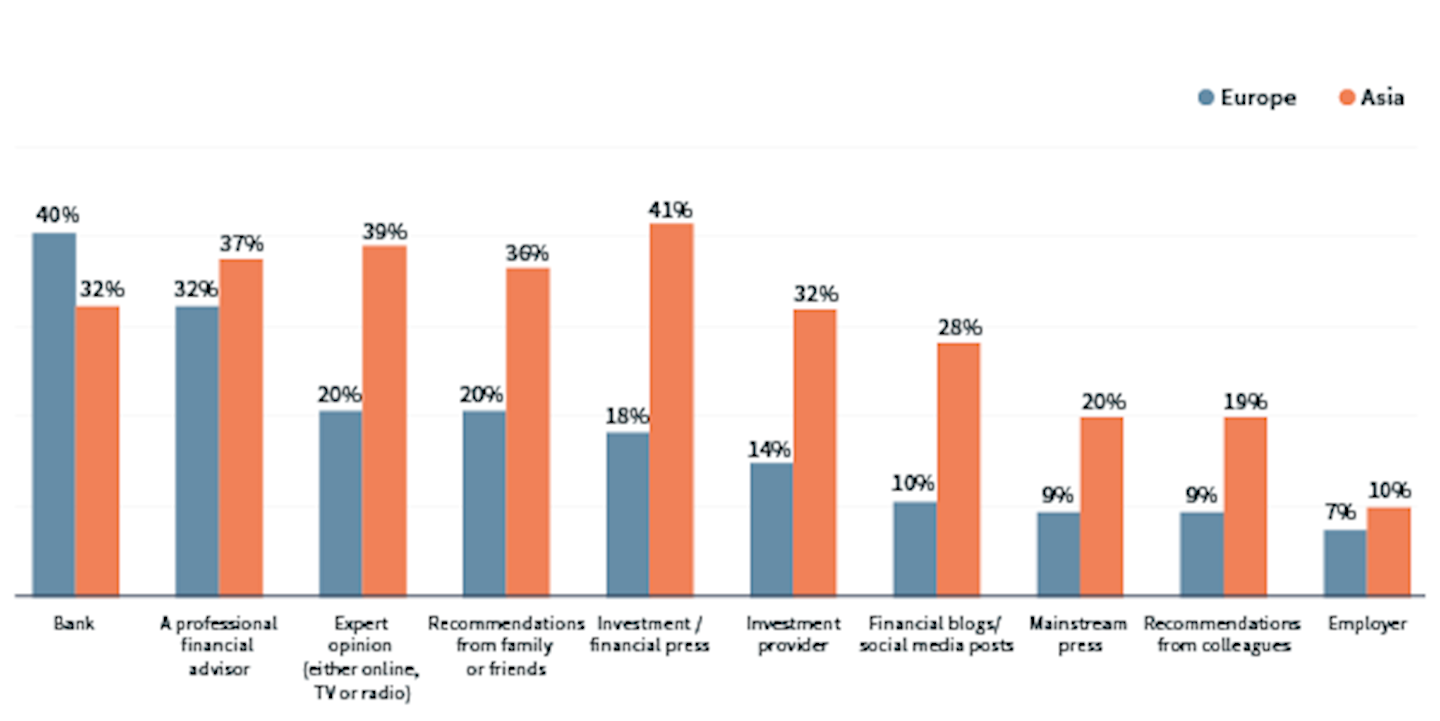

The positive news is that across both European and Asian markets a significant proportion of investors cite professionals – either their bank or a professional financial adviser – as being a key influence on their investment decision making.

However, what these findings also show us is that we cannot be blinkered into assuming that investors get all of their information from the industry itself. Clearly, many invest without the support of professional advice at all.

In Europe, where advice channels are typically more mature, the importance of other influencers drops well below the level of influence afforded to professionals. Among the Asian markets, where advice channels are often less developed, other influences are competing far more strongly with that of professionals. In the Philippines, for example, friends and family are the single greatest influence, while in Indonesia that honour goes to the financial press.

The importance of professional advice cannot be overstated when it comes to retail investments – particularly as few investors can afford to get things wrong. In the world of ESG investing, where the range of factors in play are so much greater than in non-ESG investments, this is even more true. Investors don’t just need to make the right decision financially, but also environmentally, socially and potentially ethically.

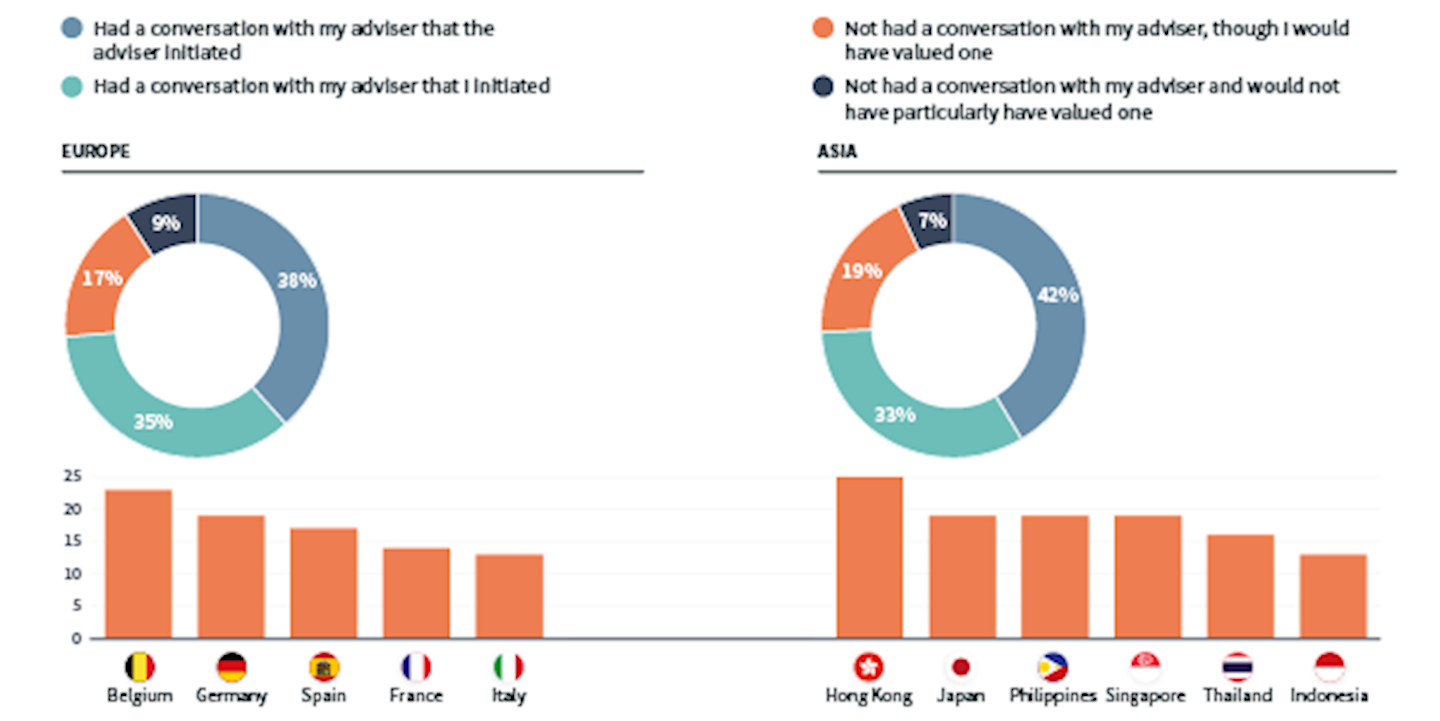

What is vital, then, is that when investors are seeking professional advice, their ESG preferences are taken into consideration. These conversations, though, are not happening as often as they should. Over one-in-four advised investors across both Europe (26%) and Asia (26%) have not had a conversation with their adviser about ESG or responsible investing at all. Furthermore, conversations that have taken place are almost as likely to be investor initiated as they are to be adviser initiated.

Many advisers still find ESG conversations difficult. Given the fact that these conversations are relatively new in the retail space and that hard reliable data can be difficult to come by, then this is perhaps not a surprise. That said, the responsibility should not be on the customer to initiate these conversations. Intermediaries could, and, from a regulatory perspective in many markets, should be taking a more proactive stance in highlighting responsible investment options. Given the increasing regulatory focus on this issue, there may be significant consequences for intermediaries failing to do so.

It should therefore be good news to advisers across the globe that investor appetite for engagement and information is high. As many as one-in-four advised investors in Hong Kong are yet to have a conversation with their adviser about ESG but would welcome one. There is a sizable minority feeling the same way across all markets.

Our hope is that this hidden opportunity should provide enough of a “carrot” to encourage advisers to have the ESG conversation with all of their clients. If it is not, then the regulatory “stick” will undoubtedly do so.